Accelerate tokenization

Olasn streamlines the tokenization and lifecycle management of complex financial instruments. It provides flexible representation of assets through standard interfaces, mitigates risks associated with complex asset movements, and automates straight-through processing.

Accelerate tokenization

Olasn streamlines the tokenization and lifecycle management of complex financial instruments. It provides flexible representation of assets through standard interfaces, mitigates risks associated with complex asset movements, and automates straight-through processing.

Control the Cycle

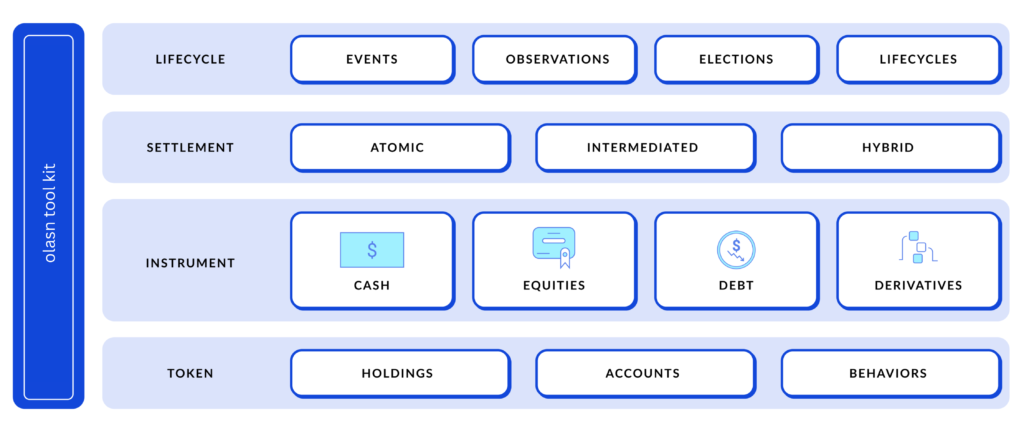

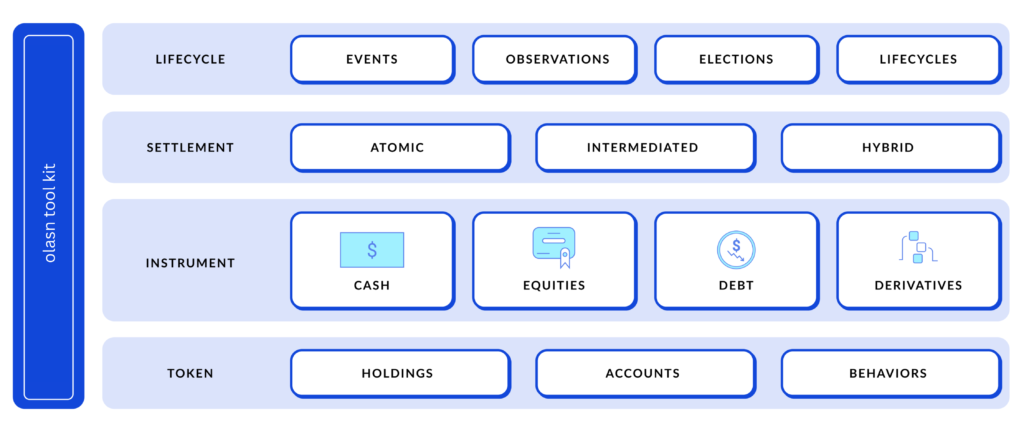

Olasn has the capability to model complex financial instruments and their complete asset lifecycle. Unlike many other solutions that only tokenize asset ownership, which merely scratches the surface of the value proposition of digital assets. With Olasn’s comprehensive asset modeling capabilities, you can accelerate development efforts, opening up new revenue streams by bringing these solutions to market more quickly.

Asset Extendibility

Asset-agnostic workflows

Workflows can be developed irrespective of the specific asset being handled.

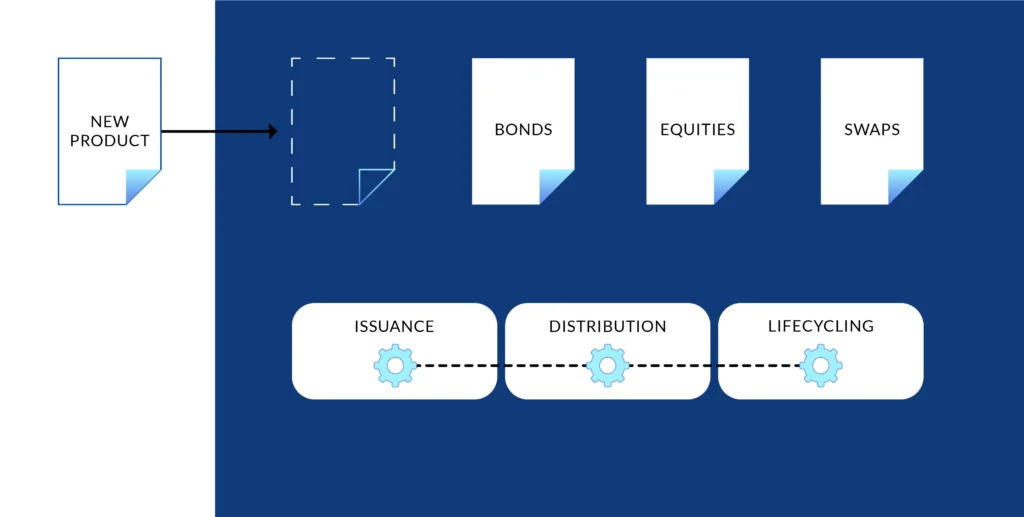

Scalable product repository

New assets and products can be swiftly and effortlessly integrated.

Ready-made asset templates

Olasn offers pre-configured models for diverse asset categories and varieties.

The manual and disjointed lifecycle management of financial instruments results in errors and delays.

To streamline operations and drive cost efficiencies, modern businesses require heightened automation and real-time transactions facilitated by a centralized data source, all while safeguarding counterparties’ privacy. Olasn facilitates end-to-end lifecycle management for various financial instruments, irrespective of the underlying technology infrastructure, by easily defining and rigorously executing transactions based on lifecycle events. Utilize robust modeling capabilities for the lifecycle conditions and events of diverse asset types. Automatically enforce participants’ rights and obligations throughout the asset’s lifecycle using a robust smart contract framework. Enhance transparency among participants while consolidating and automating redundant lifecycle processes. Reduce costs and reconciliation efforts by integrating historically fragmented data silos without compromising privacy.